Decentralized Court

Zeitgeist implements a decentralized court to handle disputes that may arise in the resolution of prediction markets outcomes.

The court system is responsible for ensuring that accurate information is added to the blockchain. Prediction markets, which rely on truthful data, reward traders who base their decisions on accurate information. If someone provides false information, they will be punished, while those who share accurate information will be rewarded. In essence, the court is a stake-weighted plurality decision-making machine. Zeitgeist's court makes use of the so-called Schelling point. This is achieved by voting in secret and revealing the raw vote information later. The outcome with the most votes wins (plurality). The court serves as a dispute resolution mechanism. The court is inspired by Kleros, a project that has already experimented with an on-chain court system.

How to participate?

Anyone can participate by joining the court system as a juror or delegator. As a juror, you are responsible for supplying the truthful outcome of a prediction market by voting and revealing the raw vote information. As a delegator, you can delegate your voting rights to active jurors.

What is the process of the court system?

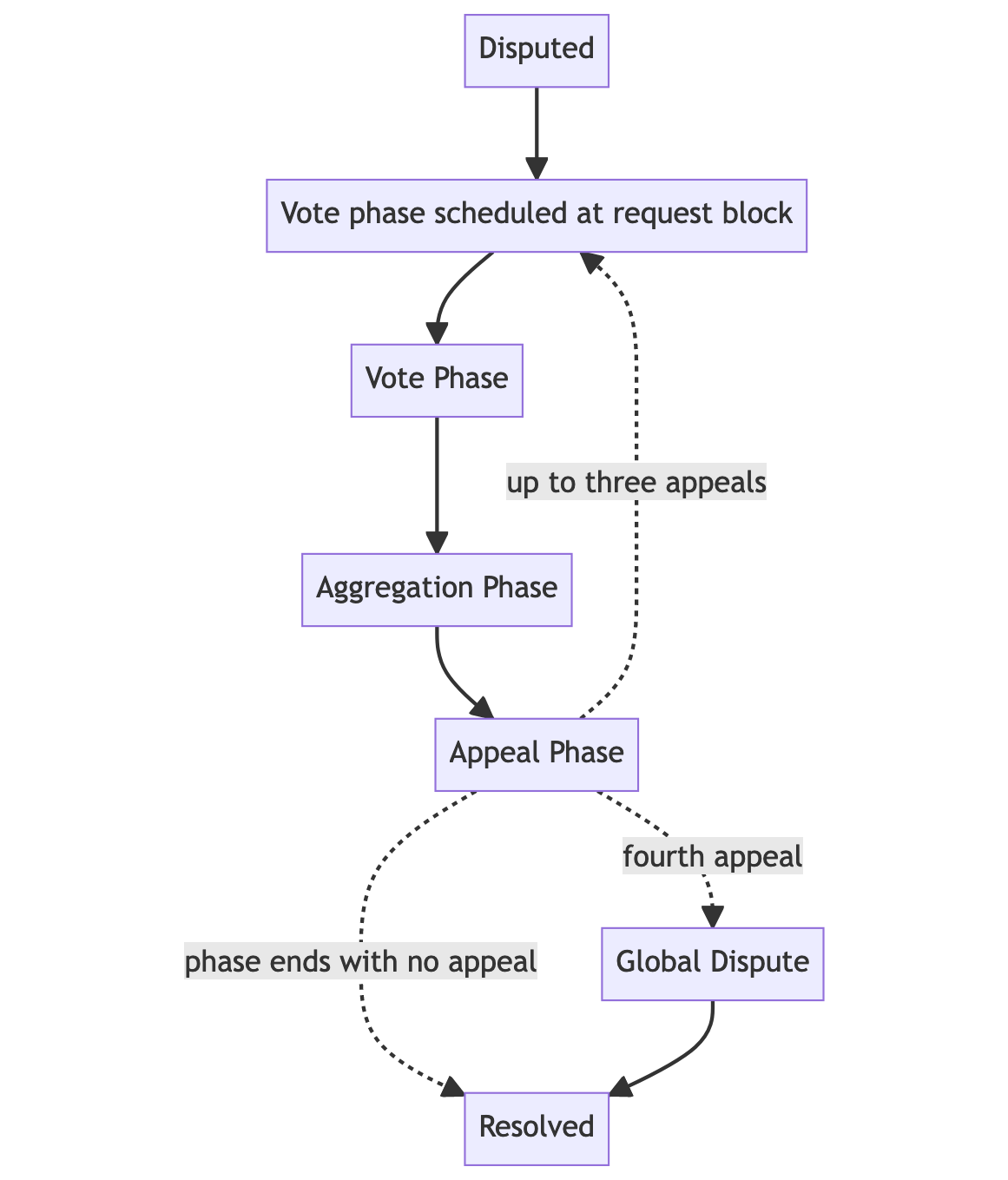

Suppose the oracle submitted a wrong outcome for a prediction market. Anyone can

bring the market into the Disputed state. At this point the court takes over.

At a known request block in the future, the Vote Phase begins. During the vote

phase the jurors cast their votes as encrypted hashes. After the vote phase

ends, during the Aggregation Phase, the jurors publicly reveal their votes.

The raw vote information can be matched to the encrypted hash. If no one appeals

during the Appeal Phase, the outcome with the most votes wins. If someone

appeals, the court schedules a new vote phase. This can be repeated up to three

times. At the forth appeal, the global dispute system takes over. The global

dispute system is a token voting mechanism that involves all ZTG holders to

resolve the market on the most voted outcome.

Details

Dispute Management within Court

If the oracle submits the wrong outcome, disputes come into play. Anyone can dispute the oracle report, and once a dispute is triggered, the court takes over. The court is comprised of jurors and delegators who need to lock a certain amount of ZTG tokens to join the court system. The more tokens locked, the higher the probability of being selected as an active juror or delegator, who risks funds on behalf of delegated jurors. Delegators can transfer their voting rights to active jurors, who participate in the voting system. The court uses a plurality voting system, meaning the outcome with the most votes wins. Each market is associated with one court case, which can be appealed multiple times.

Global Disputes as the Last Instance

If the number of appeals reaches a certain threshold (currently three appeals)

or if during the appeal period (or dispute_duration) the total unconsumed

stake (see “The Selection Algorithm”) is below the

necessary draw weights (see

“Calculating necessary draw weights”),

the global dispute system can be initiated by anyone. This global dispute system

allows all ZTG token holders to lock funds based on their beliefs. The outcome

with the most locked balance wins and serves as the final outcome for traders to

rely on for redemption. Global dispute voting participants have all of their

funds unlocked after the winner is determined.

Joining the Court

You can either join the court (extrinsic join_court) as an active juror, who

is responsible for voting, or be a delegator and delegate (extrinsic delegate)

funds to active jurors. It is important to note that the court pool, which

contains all jurors and delegators, is bounded in size (config parameter

MaxCourtParticipants). If the court pool is full, the lowest-staked

participant is about to be replaced by a new and higher-staked participant

(juror or delegator) account id. For this reason, the court pool is sorted by

the staked amount of each participant. This comes in handy in order to use

binary searches for items inside the court pool. Court participants can increase

their stake at any time by calling join_court or delegate with a higher

amount than the previous call to these functions. To decrease the stake, it’s

necessary to exit the court (see ”Exiting court”). To

update the pool item associated to a court participant, there are two binary

searches, the first for finding the pool item (the search key is a tuple of

stake and the participant account id) and with the previous data and the second

for inserting the updated data inside the pool again.

For the delegate extrinsic, the function argument delegations contains a

list of account ids. The dispatch function ensures that the list of

delegations contains actually account ids which are actively participating

jurors. The list needs to contain at least one account and all account ids need

to be unique.

Exiting the Court

Each juror and delegator can exit the court system to retrieve their remaining

funds. If the juror or delegator is still actively involved in inner court

cases, only the unused (non-active) funds are returned. The unused stake is

equivalent to the stake that was not already selected by the selection algorithm

(see “The Selection Algorithm”). In order to exit

the court and get the funds back as a juror or delegator, one has to call the

prepare_exit_court extrinsic. This extrinsic removes the participant from the

court pool and saves the current block number to notice when the unused funds

can be returned.

With the introduction of the inflation period it is required to restrict court

hopping. It is possible that users enter the court whenever the rewards of the

inflationary system get spend (see chapter “Incentives”). Thus,

we put a locking period of InflationPeriod in place in the case that a juror

wants to exit the court. So after a participant requested to leave the court

system (extrinsic prepare_exit_court), the participant has to wait at least

another inflation period to get the staked funds back. To finally return the

unused funds, the participant needs to invoke the exit_court dispatch

function. The used funds (active_lock) still remain locked.

Calculating Necessary Draw Weights

If jurors vote against the plurality decision, they are penalized by a multiple

of a constant amount (n * MinJurorStake). The penalized amount is rewarded

proportionally to the jurors and delegators who backed the most-voted outcome.

The amount of penalty risk depends on the juror's overall stake. When a court

case is triggered, the court requests a small multiple of the constant amount

(currently 31 * MinJurorStake) from the total stake of all jurors and

delegators randomly. The current configuration of MinJurorStake is 500 ZTG.

So, 31 * 500 ZTG = 15,500 ZTG are randomly drawn from the total stake for the

first court round.

The formula to determine the necessary requested vote weight for each appeal is as follows:

2^(appeal_number) * 31 + 2^(appeal_number) - 1

Assume one specific court case is in the last appeal round (3). The number of

randomly selected draw weights for jurors and delegators is 255, and,

therefore, the amount of requested ZTG is 127,500 ZTG.

The Selection Algorithm

Here is the code reference to the selection algorithm.

The court pool keeps track of all the stake of the jurors and delegators to

randomly select n * MinJurorStake draw weights from it. It is important to

note that if some of the juror’s or delegator’s stake was previously already

selected, the rule of drawing without replacement is followed. This is

accomplished by saving the consumed_stake to the pool item’s storage. For new

draws the unconsumed stake is calculated by the total stake subtracted by

the consumed_stake. The higher the unconsumed stake, the higher the

probability to get selected by the algorithm. In addition, if the unconsumed

stake is not exactly divisible by MinJurorStake, it is rounded down

(unconsumed = unconsumed - (unconsumed % MinJurorStake).

The active_lock is essentially equivalent to the unconsumed stake, but

restricts the court participant to return the funds behind this active lock.

Hence, the active_lock is not defined inside the court pool, but individually

for each participant (storage map Participants).

To randomly draw n numbers without replacement, a partial version of the

Fisher-Yates shuffle algorithm

(function get_n_random_section_ends) is used. The unconsumed total stake of

all jurors and delegators is divided by MinJurorStake to get the

sections_len. The result are n random numbers between 1 and

sections_len, which get multiplied by MinJurorStake to receive a random

subset of all section ends for the cumulated juror’s and delegator’s stakes.

That’s why cumulative_section_ends exists. It adds up all the unconsumed

stake of the court participants, saves for each participant the cumulative

section end, and the generated random subset can be matched to each associated

account id (juror or delegator). One randomly selected draw weight is equal to

one MinJurorStake and associated to one juror or delegator account id.

Delegation of Draw Weight

If one draw weight of a delegator is selected by the algorithm (see

”The selection algorithm”), one random delegated

juror is chosen out of the delegations list. This delegations list was

specified inside the call argument of the extrinsic delegate by the delegator.

There is one edge case to note here. At the point of calling delegate the

delegations list is checked, whether the specified account ids are actually

valid jurors of the court system. If not, the delegate extrinsic fails. But at

the time of the selection process, the delegations list could contain invalid

account ids, which don’t represent proper jurors anymore (for example the juror

exited the court system). For this reason only the actual contained jurors are

taken into consideration of all delegations. If there are no valid jurors

inside the delegations list, the delegator is removed from the court pool

(error inside the code: SelectionError::NoValidDelegatedJuror).

For delegations a vote weight (code reference: SelectionAdd::DelegationWeight)

goes to a random and valid juror from the delegations list, but the delegator

risks (slashable and code reference SelectionAdd::DelegationStake) the

MinJurorStake associated to the vote weight. If the juror makes bad decisions,

the delegator loses the selected MinJurorStake.

Voting at predefined Time Points

Jurors are requested to vote in a periodic interval (RequestInterval) at a

known request block in the future. This ensures that jurors only need to check

at predefined times if they need to take action. If there wasn’t this concept of

predefined requests, the jurors would have needed to check in a much smaller

time interval if they are selected in court cases.

Commitment Voting

The voting system uses a commit-reveal scheme, which is required to prevent

jurors from simply voting for the obvious plurality decision. There are voting,

aggregation, and appeal phases. During the voting phase, jurors cast their votes

as encrypted hashes (extrinsic vote), which must later be revealed (extrinsic

reveal_vote) as raw information. If a juror fails to vote or reveal their

vote, they lose their stake for that specific court case. The encrypted hash

consists of a BlakeTwo256 hash of the juror account, the vote item (outcome),

and a salt. The salt is a hash derived from the juror's signature of the

specific court ID. Without a salt, a malicious actor could try every vote item

to obtain raw information. If a juror's salt is known before the voting phase

ends, they could be exposed and penalized (extrinsic denounce_vote) by those

aware of the salt. This adds a layer of protection against cheating and

increases trust in the system.

Appeals

After the aggregation phase ends and all jurors have had the chance to make

their votes public, anyone can appeal the plurality decision (during the appeal

period). This triggers a new court round with more requested court participants

stakes or (in case after the last round) allows a global dispute to take over.

If nobody appeals, the court resolves based on the plurality decision of the

last court round. Finally, the losers must pay the winners proportionally to

their selected stakes for the specific court case (extrinsic

reassign_court_stakes).

In order to make an appeal, the caller of appeal has to reserve a bond. The

cost of an appeal is calculated as following:

cost of appeal = AppealBond * 2^(appeal_number + 1).

- First appeal cost:

2000 ZTG (AppealBond) * 2^1 = 4000 ZTG - Second appeal cost:

2000 ZTG (AppealBond) * 2^2 = 8000 ZTG - Third appeal cost:

2000 ZTG (AppealBond) + 2^3 = 16000 ZTG

At the end of the appeal period and if there are no further appeals, all accounts which provided appeal bonds and didn’t appeal on the winner outcome, get their funds back. In this case, if the appealed outcome is not equal to the winner outcome, the appeal was justified. Otherwise the appeal bond is slashed and given to the treasury. This punishes the malicious behaviour that someone appeals the correct outcome.

The last possible call to appeal is necessary for the global dispute to get

triggered, because there has to be some kind of financial commitment to appeal

the winner outcome of the last appeal round.

Determining the Winner Outcome

The basic concept is to get the outcome with the most juror vote weights and use that as winner outcome. But there are two edge cases with that approach. If there are no jurors who actually revealed the raw vote information, because of different reasons like inactivity, denounces or other reasons, the court uses the oracle report as the winner outcome. The second edge case is that there are more than two outcomes, which received the same amount of votes. In this case the court resolves on the winner outcome of the last appeal round. If there was no previous appeal round, the court resolves on the oracle report again.

Incentives

By making good decisions, you can be rewarded by those who lose. This is done by

the extrinsic reassign_court_stakes. At the end of the appeal phase, the court

resolves on a winning outcome (see

”Determining the winner outcome”). This

winner outcome is then compared to the jurors voted outcomes. All jurors and

delegators who sided with a different outcome to the winner outcome get slashed

according to their draw weights. All jurors who failed to vote or failed to

reveal the encrypted vote or got denounced, as well as their delegators, get

also slashed according to their draw weights. All jurors and their delegators,

who sided with the winner outcome get the previously mentioned slashed funds

proportional to their share of all the other winner stake

(total_winner_stake).

Additionally, the court system is incentivized by inflation. Participants who

stake funds in the court receive newly minted tokens proportional to their

stake. The current configuration involves a yearly inflation rate of 2% for

all jurors and delegators in the court system. Inflation is applied at regular

intervals, known as InflationPeriod, to reduce the strain on the blockchain.

To prevent users from joining the court just to receive token emissions (court

hopping), they must remain in the court for at least one full InflationPeriod

before they can receive inflation rewards. The block number at the point of a

participant joining the court system is saved as joined_at in the court pool

item. Assume now is the current block number, the inflation is rewarded to a

participant if the following condition is true:

now - joined_at ≥ InflationPeriod.

The YearlyInflation can be configured by a MonetaryGovernanceOrigin using

the extrinsic set_inflation.

The reward per participant is calculated as the following:

YearlyInflationAmount = YearlyInflation * TotalIssuance

IssuePerBlock = YearlyInflationAmount / BlocksPerYear

InflationPeriodMint = IssuePerBlock * InflationPeriod

for (Participant, ParticipantStake) in CourtPool {

Share = ParticipantStake / ParticipantsTotalStake;

MintAmount = Share * InflationPeriodMint;

deposit(Participant, MintAmount)

}

Terminology

- Court Hopping: Joining the court just to receive token emission benefits and then exiting the court.

- Court Pool: All jurors and delegators.

- Delegator: An account which gives its vote power to jurors.

- Draw Weight: One slash-able

MinJurorStakethat belongs to one vote weight. - Global Dispute: A token voting mechanism for all ZTG holders.

- Juror: An account which is responsible to vote in secret and reveal the raw information later on.

- Participant: A juror or delegator account inside the court pool.

- Vote Weight: The derivative voting value of one draw weight; it represents one

MinJurorStake.